If you’re running a business, regardless of size, you instinctively know how important accounting is to long-term success. Thankfully, there are tools available to help you manage cash flow, track expenses, prepare for tax liabilities, manage invoicing, and much more.

The Challenge – You need software that works for your unique situation. Using a product that’s not scalable to your business size or setup can result in major headaches, including paying for features you won’t use or not being empowered to do more to ensure business growth.

The Solution – QuickBooks caters to all types of businesses, and offers two unique options to meet individual preference:

- QuickBooks Self-Employed (QBSE)

- QuickBooks Online (QBO)

There are also other versions, such as QuickBooks Desktop Enterprise, QuickBooks Payroll, QuickBooks Live, etc. However, this article will specifically look at QuickBooks Online vs QuickBooks Self Employed. For an overview of all available versions, see our Introduction to QuickBooks.

Below are the details of each, so you can make an educated decision as to which version of QuickBooks will be best for your needs.

QuickBooks Self-Employed at-a-glance

Check out our guide on How to Use QuickBooks Self-Employed

QuickBooks Self-Employed is an accounting package that covers the basic features a solopreneur may need as it relates to:

- Managing both personal and business accounting tasks

- Estimating and paying your taxes (both with your state and the IRS)

Who is it best suited for?

The QuickBooks Self-Employed platform was designed with a very specific audience in mind. If you need to file a Schedule C document with Form 1040 during tax season, this is your accounting solution. It caters to business owners with simple business structures. This means no employees and/or contractors, and very few customers that need to be invoiced.

If you have only one income stream and pay most of your expenses with cash or a card (not checks), this is a great option to consider.

Users often belong to one of these groups:

- Uber/Lyft drivers and other gig economy workers

- Independent contractors and consultants

- Sole proprietors

- Freelancers

- Realtors

In many cases, people who use Quickbooks Self-Employed don’t need to spend a lot on an accounting program. But they do need something that is simple, cost-effective, and easier to manage than manually entering data into spreadsheets.

An important note: If you know your business will grow in the future and you’ll likely be hiring employees, have additional income streams, and/or require more advanced reporting, you’ll probably outgrow this program and may want to consider Quickbooks Online instead.

Benefits of QuickBooks Self-Employed

Quickbooks Self-Employed:

- Is cost-effective

- Has user-friendly features

- Is easy to set up

- Includes basic invoicing features

- Makes it easy to manage personal and business transactions on one platform

- Is accessible anytime, anywhere – even via your mobile device (Android/iOS)

- Has built-in tools to automate mileage tracking

- Can integrate with Turbotax for those who do their own tax filing (and pricing for the tax bundle is a good bargain)

And even though it’s a very basic program, you can still invite one accountant to help assist with things during tax season. That means you can do your own bookkeeping throughout the year, and easily give a CPA access to your data when it’s tax time. Another benefit of QuickBooks (all versions): Nearly every CPA, bookkeeper, and accounting professional are familiar with the software.

Unique features of QuickBooks Self-Employed

Quickbooks Self-Employed draws a huge following because it caters to a unique niche. These features make life easy for people who don’t want the hassles of more elaborate accounting software.

Automated processes

People who use QuickBooks Self-Employed often have fewer business dealings and factors to manage, but still struggle to properly document everything, including:

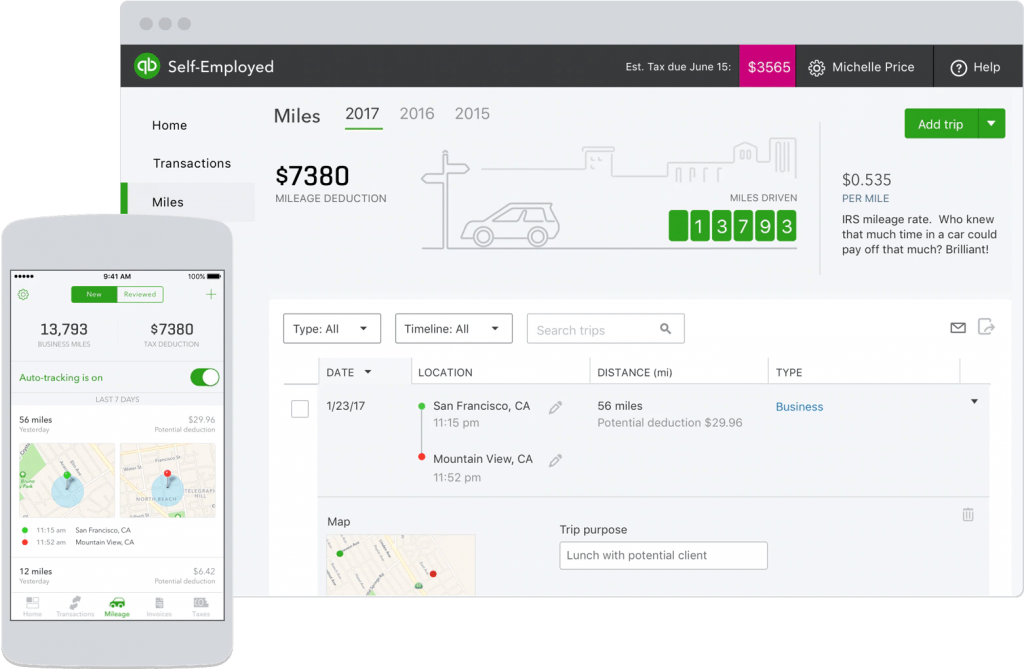

Tracking mileage

This can have an impact on your tax deductions, especially if you’re a ridesharing or delivery driver. With Quickbooks Self-Employed, you’ll have a detailed record of all your trips. With the mobile app, you can even automate business mileage tracking.

Documenting and organizing receipts

File everything in one place by attaching photographs of receipts to transactions. That’s instant, automated filing. If you are your own bookkeeper, the tools from QBSE will make your life a lot easier.

Managing transactions

Connect your bank accounts to the software and import transactions to allocate them. Set up rules and categories, and the program will automatically allocate them for you.

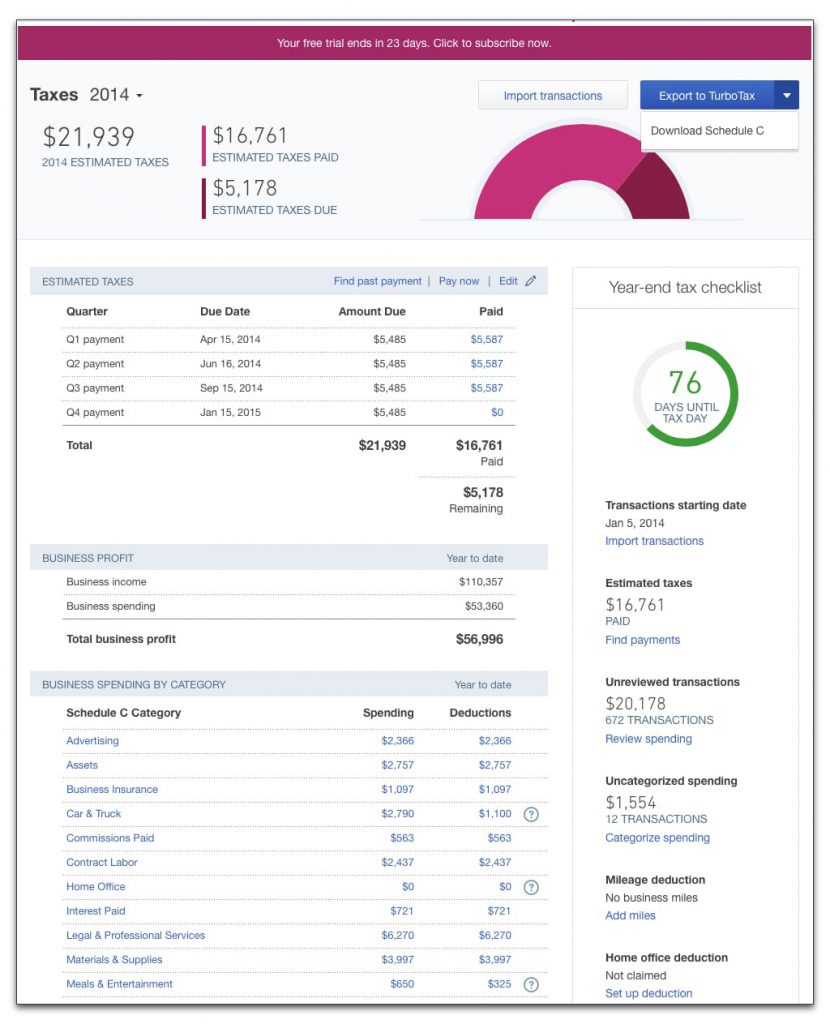

Makes taxes easier

Easy tax management is a huge driving force behind how this program was designed. QuickBooks Self-Employed will remind you of due dates, and it continually projects estimated tax payments to keep you on track.

- Both federal and state tax returns are supported (you’ll need the TurboTax Bundle for this)

- To make your Schedule C tax return easy, the software will transfer relevant information to TurboTax if you opt for this feature. This add-on will do your calculations for you.

- TurboTax is advanced enough to identify relevant deductions so you can lower your tax liability

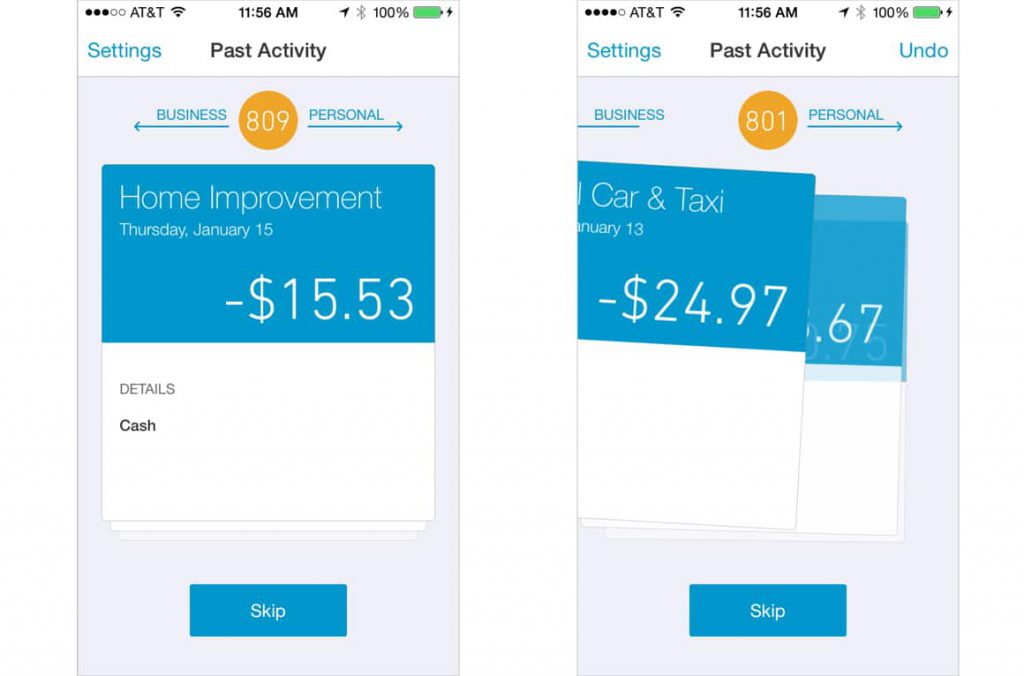

Effortlessly keeps business and personal matters apart

If you’re running this small business on the side or using your personal vehicle for Uber, it can get overwhelming keeping personal and business transactions separate. At the same time, to maximize your tax deductions, you definitely want to track as much as possible. With Quickbooks Self-Employed:

- The bank account setup offers categories relating to business expenses and personal expenses

- By only adding your business checking account (and business credit card accounts), you can ensure that only business income (and not personal, W2 income) is tracked on the business side

- The mileage app allows you to mark which trips relate to each category

- All transactions can be allocated to one of the two categories

- Tracking profit & loss is easier as you can separate business and personal transactions

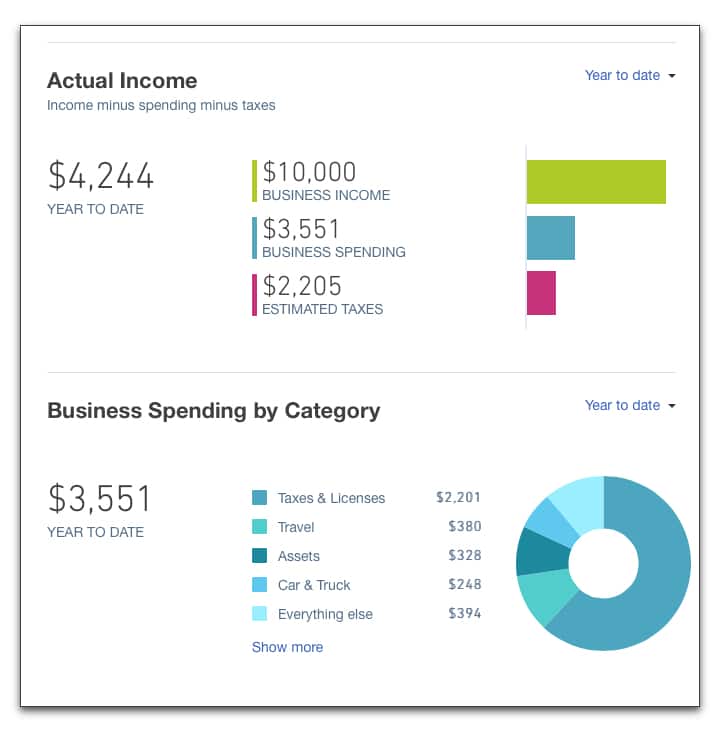

Easy paperwork and reporting

When you keep your data up to date, you can view projected numbers (such as annual profit) at any time. The system will also generate Profit and Loss (P&L) statements, as well as your tax summary.

Although there aren’t as many reports to run as with other accounting software, the P&L statement is often all a solopreneur needs. The other reports generated are only really relevant for a tax consultant.

QuickBooks Online at-a-glance

The other popular version of QuickBooks for small businesses is QuickBooks Online. This is an accounting software package that caters to small businesses and offers more advanced features than QBSE. It’s a dynamic, yet simple tool, that allows you to do basic accounting tasks such as sending invoices and tracking inventory.

Check out our guide on How to Use QuickBooks Online

Who is it best suited for?

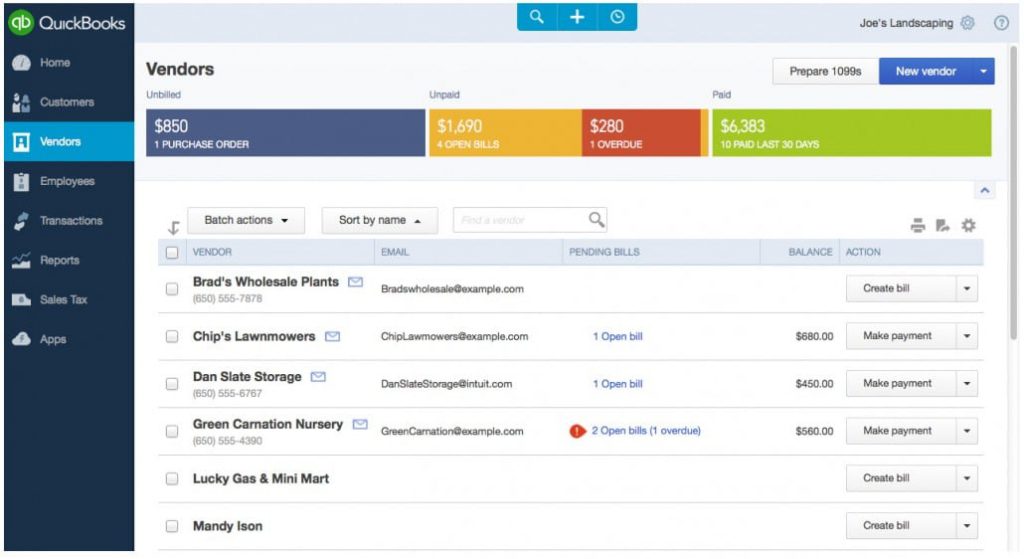

Quickbooks Online is designed to track the transactions of business accounts. It has more advanced features, so it can track sales tax, keep track of inventory, etc.

It’s a step up from QuickBooks Self-Employed, and can support the following:

- Product sales and purchases

- Accounts payable

- Employee records

- The hiring of 1099 contractors

Quickbooks Online is designed for small businesses that file taxes as:

- Partnerships

- S-Corps

- C-Corps

So, for example, if you have an e-Commerce store through Shopify, this accounting solution is an ideal option.

Benefits of QuickBooks Online

Here are a few features that small business owners love about QuickBooks Online:

- Automatically sends invoices, statement, and reports

- Nightly downloads of bank transactions keep data up to date

- Allows multiple windows to be open simultaneously

- The payroll subscription option adds versatility for firms with employees

- The ability to access data from anywhere via any device (all devices are synced, even your mobile phone)

- Time tracking makes it easier to track projects & bill accurately

What truly sets Quickbooks online apart is how it caters to small businesses. It’s not jam-packed with unnecessary features that jack up the price, but it does offer nearly everything that you would need to track your business’ expenses and financial performance. What’s more:

- It allows for multiple users

- You can import data from other QuickBooks programs

- You can track inventory

- It offers many optional add-on features to expand the functionality

QuickBooks Self-Employed vs QuickBooks Online

Main differences between QuickBooks Online and QuickBooks Self-Employed

Both programs are impressive, but only one will serve you best. A summary of differences helps to clarify in which scenarios you’ll find each one dynamic:

- Cost – QuickBooks Online has a higher monthly premium (view details below)

- Reporting – Quickbooks Self-Employed only provides P&L statements, while Quickbooks Online facilitates more advanced reporting

- Mileage – Only Quickbooks Self-Employed is designed to track mileage

- Business Features – Features essential to small businesses, such as inventory tracking and managing bills, is only possible with QuickBooks Online

- 1099 Contractors – You can only pay 1099 contractors via QuickBooks Online

- Personal vs Business – Only Quickbooks Self-Employed is designed to help manage personal and business transactions in a single platform

Cost Comparisons

- QuickBooks Self-Employed costs $15/month. There are limits to what it can do, however.

- The QuickBooks Self-Employed TurboTax Bundle is $25/month

- QuickBooks Online ranges from $25 to $150 per month, depending on the plan you choose. More advanced plans offer extra features, such as:

- Multi-user access

- Inventory tracking

- The ability to pay 1099 contractors

- The ability to manage sales taxes

- The ability to pay quarterly taxes online

A few important things to keep in mind related to costs:

- Free trial periods apply, but you won’t be able to take advantage of discounted pricing if you sign up for a free trial

- These packages can be canceled at any time (non-contract)

- If you opt for the TurboTax option, one federal and one state tax return will be filed for free

- QuickBooks often offers 50% discounts for the first three months on various products – however, this replaces the free trial offer.

Tips on deciding which is best

- Remember that you can’t convert QuickBooks Self-Employed to any other version. If you think your business will grow into a larger entity, you’re better off choosing Quickbooks Online.

- QuickBooks Self-Employed doesn’t allow customization (even on invoices), but the Online version does.

- Many apps integrate easily with QuickBooks Online, but not with the Self-Employed version.