Student debt is an enormous burden, not just for young Americans but the American economy as a whole. It has surpassed both auto loan and credit card debt to become the second-highest source of consumer debt – being beaten out only by mortgage loans. While the average interest rate for a student loan isn’t as high as for these other types of debt, the sheer amount of student loan debt is a serious concern. Increasingly, college students in America are borrowing vast sums against their future in order to finance a college education.

But where is all that debt coming from? Who holds it? Is it still increasing… and what is the future of student loans in the United States?

In August this year, Biden announced that millions of US citizens would be eligible for student loan forgiveness up to $20,000 if they had applied for and received a Pell Grant. And those who did not receive a Pell Grant would qualify for as much as $10,000 off their student loans.

While the Student Loan Forgiveness program is currently on hold, borrowers should sit tight and wait to see what happens.

To paint a clear picture of the current crisis though, we have consolidated the following student loan debt statistics.

How much student debt is owed?

With 60% of all students having some form of debt by graduation–either through private loans issued by financial institutions or direct loans from the government–the sheer amount of debt is staggering.

- The collective student debt currently stands at $1.75 trillion in the United States.

- According to a January 2022 Census data analysis, this debt is owed by 45 million people across all demographics or one in seven Americans.

- Federal student loans account for 92% of student debt, and the remaining percentage is private student loans.

- $500 billion in federal student debt is owed by borrowers between the ages of 25 to 34. Between $10,000 and $40,000 is owed by the majority of people in this age group.

- However, student debt is carried well into the middle-aged group and beyond. Therefore, $620 billion in student loans are owed by Americans between the ages of 35 to 49.

What is the average U.S. student loan debt?

- Each borrower owes an average student debt of $37,172.

- The average US household owes $58,957 in student debt.

- More than 600,000 borrowers in the US have more than $200,000 in student debt, and this number continues to rise.

- 55% of students from public four-year institutions had student loans.

- 57% of students from private nonprofit four-year institutions also had student debt.

- The average total amount of outstanding student loan debt for a four-year student that graduated in 2016 was $37,102 – a 78% increase from just 10 years earlier.

- The average monthly payment on student loans was $393 in 2016, up from $227 in 2005.

To put it in perspective, students graduating today that owe $37,000 could have instead paid for: a Tesla Model 3 or a new Audi A4, the down payment on your average home, or the bootstrapping of a small business.

Federal debt

The federal government is the servicer for a vast majority of student loans. Most, however, are managed or guaranteed by a corporation.

- According to the Federal Reserve, total federal student loan debt amounts to $1.617 trillion. This makes up 92.7% of all student loan debt.

- The total number of federal student loan borrowers is 44.5 million

Private student loan debt

Private student debt or student loans from private lenders is a relatively minute fraction of the total debt.

- Total private student debt amounts to $131.1 billion at the moment.

- The number of borrowers is undisclosed, but private debt accounts for about 7.61% of all student debt.

Graduate school debt

Graduate school is an increasingly larger percentage of that debt as a large number of students are steered into graduate programs due to bachelor’s degrees no longer holding the same value.

- 65% of the total federal student debt is held by those in graduate programs.

- Graduate students borrowed $18,210 per year on average during 2015 compared to an undergrad’s $5,460.

- Master’s degrees normally take between 2 and 5 years to achieve. The median debt of a master’s degree graduate is between $42,000 and $58,539.

- The cheapest master’s degrees are an MBA. Those with an MBA averaged $42,000 in debt. Meanwhile, the average amount of medical school debt is currently hovering at $194,000 for Medicine and Health Sciences.

Check out the Federal Work Study: Facts at-a-glance

Who holds student loan debt?

Demographics of loan holders

Surprisingly, it’s not only those in younger age groups that struggle with debt.

- Only 37.5% of people with student debt are below the age of 30. The other 62.5% are older than 30.

Unsurprisingly, minorities are affected significantly by student debt.

- 77% of African American students took out a federal loan to pay for higher education compared to the 60% national average for all students.

- The average debt upon graduation is also higher for African American students. For example, In 2012, their average debt was $29,344 compared to the national median of $25,640.

- Troubles don’t end after successfully securing a job after graduation: of the total number of workers with a bachelor’s degree, African American households earn an income of 23% less than the median for the overall population.

- Examining students that began college in 2003: 50% of black students have ceased student loan repayment and gone into student loan default on their loans within 12 years due to financial insecurity (compared to a 36% default rate for Hispanic students and 21% for white students).

The problem of debt is especially acute for women.

- While women account for 66% of undergraduates nationwide, they are saddled with almost two-thirds of all student debt.

- Not only are women more likely to take on debt, but their median debt is also 9.6% more than men.

- Females do also take a longer period to repay their debt, resulting in more overall interest. This is partially due to the gender pay gap – women earn 83 cents for every $1 that men earn as of 2021.

How are student loans repaid?

Slowly… or in many cases, not at all. A sizable chunk of student loans are in limbo – or totally abandoned.

- 2.9 million borrowers are currently deferring their federal student loans. In this instance, deferment means that interest doesn’t accrue.

- 24.8 million borrowers currently have federal student loans in forbearance. Interest is still piling up for them.

- An astounding 5 million borrowers have their federal student loans in default. That means that 10% of all people with student loans haven’t made student loan payments on their debt in more than 9 months.

-

- Students that left college before completing their degree are more than twice as likely to eventually default on their loans compared to students that graduated.

- More than half of all defaulted debts are on loans that amount to less than $10,000.

Types of repayment plans

Fortunately, there’s a multitude of methods to repay student debt that’s conscious of the burden it imposes on graduates. Only a small fraction of all borrowers are on such a plan, however, 6.73 million federal loan borrowers are on an income-driven repayment plan.

Broken down by type of plan. These statistics are accurate as of April 2022 and soon to be updated:

- 2.8 million federal loan borrowers are on an income-based repayment plan. On this plan, payment is capped at 10% of total income, and payment is made for 20 years.

- 0.8 million federal loan borrowers are on an income-contingent repayment plan. On this plan, the borrower pays the lesser of 20% of discretionary income (with a 25-year term) or the equivalent of a 12-year fixed plan.

- 1.5 million federal loan borrowers are on the Pay As You Earn plan. On this plan, payment is 10% of total income for a 20-year term, but it can never exceed the estimated payment of a standard repayment plan.

- 3.3 million federal loan borrowers are on the Revised Pay As You Earn plan. On this plan, payment is capped at 10% of discretionary income, and undergraduate loan terms are extended to 20 years (grad loan terms are extended to 25 years).

The advantage of these federal repayment plans is that if the balance is not entirely paid by the end of the term, the remaining debt is forgiven.

The disadvantage is obvious: the standard federal student loan has a repayment term of 10 years. Doubling that exponentially increases the amount of interest owed and the lifetime cost of the debt.

Loan forgiveness statistics

There are two primary federal student loan forgiveness programs offered by the U.S. Department of Education.

Public Service Loan Forgiveness

You should know the following about the PSLF program:

- The PSLF program requires that you work for a qualifying employer and not necessarily a public school considered low-income in order to receive loan forgiveness. This means that you can choose to work for various government organizations at any level, be it tribal, local, state, federal, or the U.S. This also includes organizations classified as not-for-profit. They should also be tax-exempt under section 501(C)(3) of the internal revenue code. You may also work for various other not-for-profit organizations, provided they are involved in qualifying or specific types of public services.

- However, less than 15,000 students have received loan forgiveness through the PSLF or Public Service Loan Forgiveness program. In fact, only 2 in every 100 PSLF applications qualify for student loan forgiveness.

- Additionally, the loan amounts given under the PSLF program are not considered taxable by the Internal Revenue Service.

- This program forgives the remaining balance on your federal direct loans after 120 consistent or qualifying payments, which is an estimated ten years.

- However, in order for your payments to count towards the 120 installments needed for forgiveness, you’ll need to meet specific requirements.

- In order to get the ultimate value out of the program, it is suggested that you repay your loans on a repayment plan that is income-driven.

- Income-driven repayment plans are available from various sources, including Studentaid.gov.

- In order to qualify for the forgiveness loan, you need to have direct loans. Other types of federal loans, such as Perkins loans and FFEL do not qualify unless you consolidate them. To check the type of loan you have, feel free to log into Studentaid.gov.

Teacher Loan Forgiveness Program

Teachers that teach 5 consecutive years in a qualified low-income school can be forgiven between $5,000 and $17,500 of their debt. About 27,000 teachers received aid from this program in 2017.

What you should know about the Teacher Loan Forgiveness program:

- Eligible teachers may qualify for up to $5000, while specific, highly qualified secondary mathematics, special education, or science teachers may qualify for up to $17,500 in forgiveness.

- To apply and qualify, you need to be employed or hired at an eligible school as a full-time teacher for a period of five consecutive and complete years. A minimum of one of those years should be after the 1997 – 1998 academic year.

- If you spent time receiving benefits through AmeriCorps while teaching, it doesn’t count toward the five-year required teaching time for TLF.

- Perkins loans and Plus loans are not eligible for this program.

- You may apply for the Teacher Loan Forgiveness for parents in order to maximize your forgiveness amount, and this means that you won’t have to make loan payments every month. However, interest will still accumulate. If you have an overall loan amount that is more than the Teacher Loan Forgiveness program amount that would like to receive, i.e., either $5000 or $17,500, then you won’t qualify for this type of forbearance.

- You need to complete the five-year teaching requirement before you can apply for TLF.

Perkins Loan Cancellation for Teachers

The Perkins Loan Cancellation for Teachers program forgives up to 100% of the federal Perkins loan. However, you need to be a full-time teacher at a school considered low-income, or you need to teach specific subjects.

Here’s what you need to know about the Perkins Loan Cancellation for Teachers program:

- Suppose you have Perkins loans, then this program is designed to forgive your Federal Perkins loans.

- Up to a hundred percent of the loan could be canceled for service as a teacher in the following increments:

- 15% cancellation per year (first and second) years of service

- 20% cancellation (third and fourth) years

- 30% cancellation for the first year

- Please note that every amount canceled annually is inclusive of the interest accrued for that specific year.

- Check the studentaid.gov database online for the number of years you’ve been working as a teacher to find out if the school is classified as a low-income school.

- You may qualify if you teach science, mathematics, foreign languages, special education, and bilingual education, even if you don’t teach at a school considered low-income. If you teach a different subject decided by the relevant state education agency or have a shortage of qualified teachers in the relevant state, you may also qualify.

- If the school is a private school and has confirmed its non-profit status with the IRS, then private school teachers may also qualify for this program. Additionally, you may also be eligible if the school is offering secondary or elementary education as per state law.

FAFSA statistics

FAFSA, the Free Application for Federal Student Aid, is an effort by the US government to help finance higher education for students that are determined to be eligible. It’s meant to be updated and submitted yearly. Federal loans and grants are calculated from the results of the FAFSA.

According to Federal Student Aid data, of those who filed a 2020 – 21 FAFSA application for the academic year, the following was noted:

- 37% were male students, and 63% were female students.

- 47% of applicants were first-generation college students.

- 11% are either 18 years old or younger, and 41% are 25 years old or older.

- 13% are pursuing a professional or graduate degree.

- 24% have never attended college before.

- 52% are independent students, while 48% are considered dependent students.

The impact of student debt

As per the Institute for College Access and Success, and the Federal Reserve Bank of New York, over the last decade, the yearly proliferation of the student loan debt balance nationally has slowed down invariably.

Let’s take a look at the 2022 student loan debt statistics nationally:

- The total student loan debt escalated by 1.53% in the subsequent fiscal 2022 quarter, and this is the ground-level rate of escalation in the 21st century.

- The quarterly rate of escalation has accelerated by 146.5% since the fiscal quarter of 2020 and remains the same as of 2022 quarter two.

- The student debt balance decreased by 0.12% from 2022 quarter one to 2022 quarter two. This indicates a 106% lesser than the median quarterly (or once every three months) change since the 2006 first fiscal quarter.

- 92.7% of the total student loan debt was federal in 2022, quarter one, with 7.3% belonging to students who borrowed privately. Additionally, federal student loan debt decreased by 0.15% in 2022 quarter three.

- In 2022 quarter one, federal-student-loan-debt decreased by 0.27%. This is a significant decrease quarterly in over ten years.

- In 2022 quarter three, the average or median federal debt escalated to $119.94.

- From 2017 quarter two to 2022 quarter two, the federal allocation of the complete student loan debt balance escalated to 3.00%.

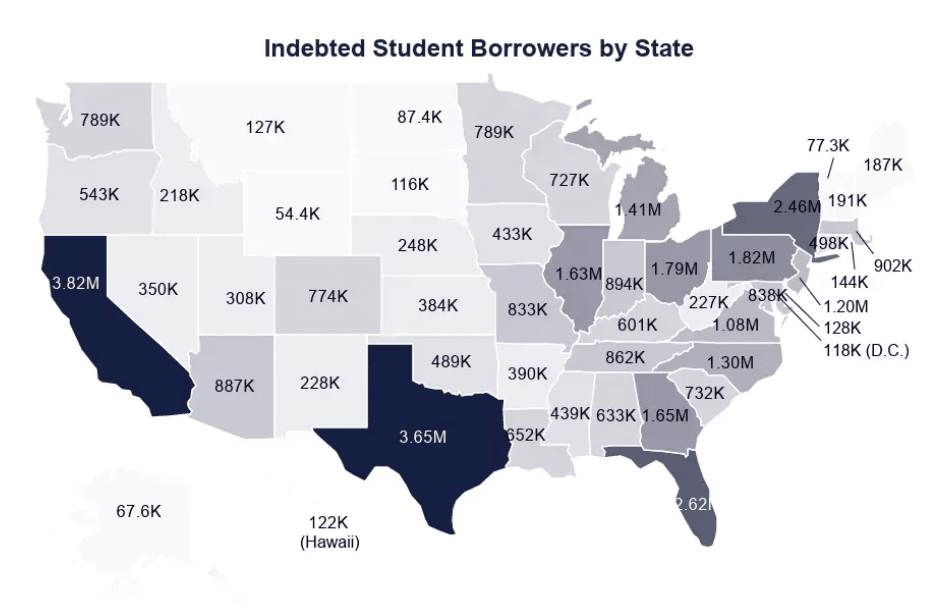

Average student loan debt by state

The amount of student debt held by Americans is more or less the size of the economy of Australia or Brazil. Additionally, over 45 million people owe an estimated total of $1.75 trillion, according to the US government. This is due to the cost of higher education continuously rising and the fact that the growth in cost has been substantially more than the increase in most other household expenses.

Additionally, the rising cost of a college education has come at a time when students receive less government support, placing a huge burden on students and families to take out student loans in order to fund education.

Consequently, funding from states has declined steadily, contributing to roughly 60% of spending on higher education prior to the pandemic.

Let’s take a look at the stats below:

[table “122” not found /]Socioeconomic factors play a huge role in debt variations among states. Some of these socioeconomic factors include a higher concentration of health specialists with medical school debt.

- When it comes to federal student loan debt, DC residents are the most likely to have student loan debt among United States residents.

- With the exclusion of DC, Maryland student loan borrowers have the highest average student loan debt.

- Georgia is the only state where the median student loan debt is over $40,000, with the exception of DC and Maryland.

- Among the states, Ohio residents are extremely likely to have student loan debt, with the exception being DC.

- The least likely state to have student loan debt is Hawaii.

- Wyoming residents are the least likely to have student loan debt out of the remaining 48 states.

- The states with the lowest average student loan debt are Puerto Rico and North Dakota.

- Aside from Portugal, $4.3 billion in student loan debt is from other US territories.

- Business owners in states like Indiana, Oklahoma and Wisconsin may have less student debt.

Let’s take a look at the map:

Average graduate debt 2022

Graduate school students today are two and a half times more likely to borrow money for education than students in 1995:

- The undergraduate student loan debt is, on average, $37,651, while $80,494 is the median debt among those with a master’s degree.

- When it comes to federal loan borrowers, the average balance on graduate student loan debt is approximately $102,913.

- The median debt among those holding a Ph.D. is $132,268.

- Approximately 14.4% of the median graduate student debt is on the borrower’s undergraduate study.

- However, the average student debt for a graduate is 145.6% more than the median debt or balance among the total number of student loan borrowers.

- The student borrowers have graduate student loan debt and also have debt from their undergraduate studies. However, the debt accrued from graduate school alone averages $88,212.

- Graduate school involves advanced degrees that exceed the bachelor’s level. Of these degrees, master’s and doctoral degrees are the most common.

- Every outstanding grad plus or direct plus loan debt has an overall balance of $58,750.

- $62,300 is the median student loan debt amongst those who received their post-baccalaureate certificate from a public institution, while graduate school alone contributes $53,774.

- $82,706 is the average student loan debt among post-baccalaureate certificate holders, was $67,221 is from graduate school only.

- The median debt among students who earned their post-baccalaureate certificate from private – nonprofit institutions is $99,433, while graduate school contributed $81,625.

- $634 billion is the total federal graduate debt as reported in 2017, according to the Congressional budget office.

- The median debt among students who attended or participated in private – for-profit institutions is $118,684, while $76,182 is accredited to graduate school alone.

- Some of the tendencies or trends in graduate school debt are that current-day graduate students are two and a half times likelier to take a student loan for education than graduate students back in 1995. In fact, since 1995, the median graduate school debt has increased twofold.

Student loan debt by age

These are the statistics for student loan debt by age:

- It has been reported by 34% of adults between the ages of 18 to 29 years that they currently have student loan debt.

- 32.5% of federal student loan debt is taken on by borrowers in their 30s.

- 22% of adults between the ages of 30 to 44 stated that they have student loan debt.

- 23.5% of adult federal student loan borrowers are under the age of 25 years.

- 8.14% of federal borrowers are at least 62 years old or older.

- 48.5% of student loan borrowers are between the ages of 25 to 34.

- The average senior citizen or 62-year-old loan borrower owes approximately $40,560 in federal education debt, and this includes parent-plus loans.

- Borrowers between the ages of 25 and 34 have an average debt of $32,430.

- Federal borrowers under 25 years old each have an average of $15,028.

- 37% of associate degree holders and 25% of bachelor’s degree holders have either defaulted or been delinquent in student loan payments at least one time by the age of 30.

Student loan debt by gender

The following are statistics on student loan debt by sex or gender:

- 52.2% of men or male bachelor’s degree holders have also taken out federal student loans.

- 61.4% of women or female bachelor’s degree holders have taken federal student loans.

- Female or women students are 49.9% most likely to take federal student loans than their masculine peers among associate degree holders.

- Females holding bachelor’s degrees borrow 42.27% further in student loans as compared to their masculine bachelor’s degree holders.

- Women associate degree holders take approximately 24.9% further student loans than male students.

Student loan debt by ethnicity

The following statistics are applicable to student loan debt by ethnicity:

- African-American or black students are highly likely to take federal loans at around 76.1%, and this is among bachelor’s degree holders.

- Alaska Native and American Indian students are unlikely to borrow from private lenders at 2.6%, and this is among all postsecondary or tertiary education students.

- Caucasian or white tertiary education students are highly likely to be presented with private loans, and approximately 7.1% borrow money from private lenders.

- African-American black student borrowers owe around 6% further than they borrowed, while Caucasian or white borrowers owe around 10% less on average.

- 17% of white student borrowers and 48% of black student borrowers owe much more than they originally borrowed four years after graduation.

- 22% of white students and 40% of black students accrue debt for graduate school, among graduate students.

- African-American or black students are most likely to borrow federal loans at 76.1%, and this is among bachelor’s degree holders.

- Alaska Native and American Indian students are least likely to borrow from private lenders at 2.6%, and this is among all postsecondary students.

- Caucasian or white postsecondary students are the most likely to receive private loans, with 7.1% borrowing from private lenders.

- African-American black students owe 6% further than what they borrowed, while Caucasian or white students owe less than 10% on average.

- 17% of white student borrowers and 48% of black student borrowers owe more than they originally took out four years after graduation.

- 22% of white students and 40% of black students accumulate debt for graduate school, among graduate students.

FAQs

Common student debt scams include promises of debt forgiveness, false refinance options, and consolidation offers that require upfront fees.

Are student loans subsidized or unsubsidized?

According to Federal Student Aid, direct subsidized loans are only available to undergraduate students with financial need for it. However, both undergraduate and graduate including professional degree students, have access to direct unsubsidized loans.

How much is the national private student loan balance?

The national private student loan balance is over $140 billion. The total federal student loan balance was $187 billion in 1995, and currently, up to 27,000 teachers have successfully had their student loan balances either completely or partially forgiven.

What is the average yearly income for a college graduate in 2021?

The annual income on average for the 2021 college graduate is $59,919, depending on the type of major.

Which state had the highest number of student loan complaints?

New York and California are the states with the highest number of private student loan complaints. New York had 222 complaints, while California had 236.

Citations:

- https://www.statista.com/chart/24477/outstanding-value-of-us-student-loans/

- https://www.nerdwallet.com/article/loans/student-loans/student-loan-2. debt#:~:text=Forty%2Dfive%20million%20Americans%20have,%24600%20billion%2C%20federal%20data%20show.

- https://www.forbes.com/advisor/student-loans/average-student-loan-statistics/

- https://meratas.com/blog/student-loan-debt-statistics-2022/

- https://www.cnbc.com/2018/02/15/heres-how-much-the-average-student-loan-borrower-owes-when-they-graduate.html

- https://www.studentloanplanner.com/student-loan-debt-statistics-average-student-loan-debt/

- https://quizlet.com/195627010/student-debt-flash-cards/

- https://www.forbes.com/advisor/student-loans/average-student-loan-statistics/

- https://www.bankrate.com/loans/student-loans/fafsa-statistics/#filing

- https://educationdata.org/student-loan-debt-statistics