After more than three years of being put on pause, student loan payments are set to resume on Oct. 1, 2023.

Tens of millions of borrowers will now need to rearrange their monthly budget in order to account for payments, but which states have the highest amount of student loan debt?

According to the U.S. Department of Education, 43.6 million Americans across the country have federal student loan debt, amounting to more than $1.64 trillion.

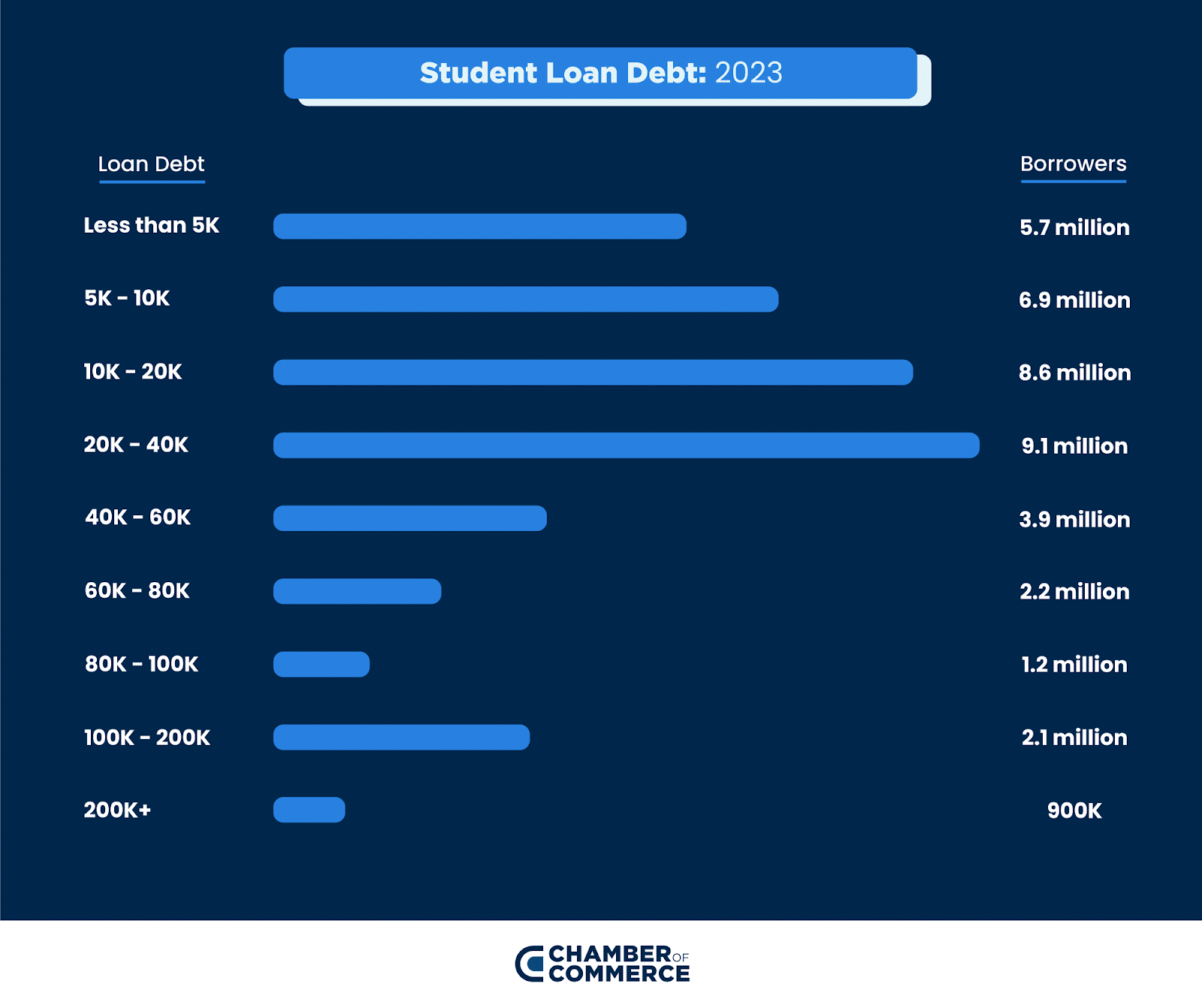

Among those who have federal student loans, nearly 70% (28 million) owe $10,000 or more, while 25% (10.3 million) owe $40,000 or more.

To determine the average student loan debt as well as student loan debt by age group, we conducted an analysis of outstanding balances on student loans across all 50 states, Washington, D.C., and Puerto Rico.

Key findings

- One-quarter of borrowers (10.3 million) owe $40,000 or more in federal student loans.

- The average federal student loan debt is $37,717.

- Since 2020, the nationwide amount of federal student loan debt has increased by $102 billion, and the number of borrowers has increased from 42.6 million to 43.6 million in 2023.

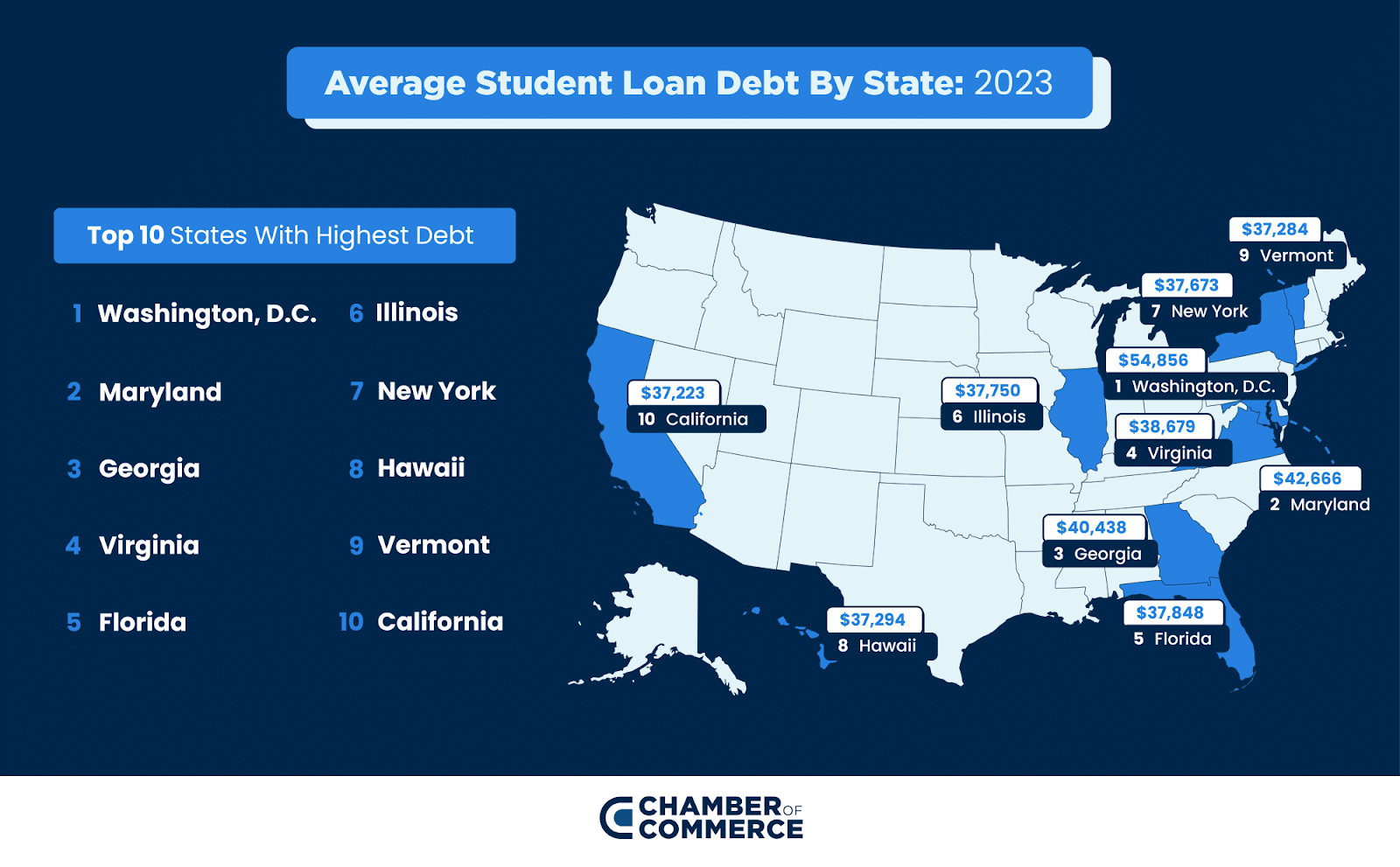

- Washington, D.C.; Maryland; Georgia; Virginia and Florida have the highest average student loan debt in the nation.

- There is not much to say about states like Indiana, Oklahoma and Wisconsin

Which states have the most student loan debt in 2023?

Since March 2020, when student loan payments were put on hold, federal student loan debt has seen a significant increase of $102 billion, according to the U.S. Department of Education.

Washington, D.C. takes the top spot in the nation for the highest average student loan debt. Borrowers in the nation’s capital owe an average of $54,856.

In Maryland, the state’s 808,600 borrowers face an average debt of $42,666, while borrowers in Georgia owe an average of $40,438.

Borrowers in Virginia and Florida round out the top five, with an average debt of $38,679 and $37,848, respectively.

Top five states with the most student loan debt

#1. Washington, D.C.

- Total Debt: $6.1 billion

- Number of Borrowers: 111,200

- Average Debt Per Borrower: $54,856

#2. Maryland

- Total Debt: $34.5 billion

- Number of Borrowers: 808,600

- Average Debt Per Borrower: $42,666

#3. Georgia

- Total Debt: $65 billion

- Number of Borrowers: 1,607,400

- Average Debt Per Borrower: $40,438

#4. Virginia

- Total Debt: $41 billion

- Number of Borrowers: 1,607,400

- Average Debt Per Borrower: $38,679

#5. Florida

- Total Debt: $95.8 billion

- Number of Borrowers: 2,531,200

- Average Debt Per Borrower: $37,848

Nationwide, the average student loan debt is $37,717. Out of the 43.6 million Americans carrying student loan debt, roughly 9.1 million borrowers owe between $20,000 and $40,000. However, a significant number of borrowers, 3 million, owe $100,000 or more.

According to the U.S. Department of Education, borrowers who attended public colleges and universities (23 million) owe $654.5 billion in student loan debt, while those who attended private schools (11.9 million) owe $506.9 billion in student loan debt.

Student loan debt by age

Student loan debt not only varies based on school type and location, but also among different age groups.

For individuals aged 24 or younger, the average student loan debt is $14,296. However, this amount more than doubles to $32,223 for those aged 25 to 34. It increases to $45,703 for those between the ages of 35 to 49.

Surprisingly, even seniors face the burden of student loan debt. In fact, more than 112 million seniors aged 62 and over owe an average of $45,636. Average student loan debt is highest for seniors living in Vermont ($55,556) and lowest for those who live in West Virginia ($36,082).

Regardless of age or location, student loan payments will resume this fall for tens of millions of Americans. It’s important for borrowers to start rearranging their monthly budgets now in order to prepare for repayments as interest will start to add up on any unpaid loans.

Methodology

To determine our ranking, we analyzed federal student loan debt balances in all 50 states as well as Washington, D.C. and Puerto Rico via the U.S. Department of Education and the Federal Student Loan Portfolio. Data were also included for borrowers who did not include a current address as well as for borrowers living outside of the U.S. states or territories listed within the report. This federal student loan portfolio includes Direct Loans, Federal Family Education Loans (FFEL), and Perkins Loans with outstanding balances.

Sources: U.S. Department of Education, Federal Student Loan Portfolio

Fair Use: Feel free to use this data and research with proper attribution linking to this study.

Media Inquiries: For media inquiries, contact [email protected]