Taxes can be intimidating, and if you run a small business you may not have time to learn all the ins-and-outs. At the same time, the stress (and financial penalties) associated with an incorrect tax filing can be disruptive to a well-functioning small business. With these factors in mind, it’s no wonder consumers have the choice of several competing tax software companies.

Summary

Similar to TaxAct, TaxSlayer is more affordable than many of its competitors while offering great features such as a simple interview-based system to input your information.

TaxSlayer is considerably more affordable than big-name companies such as H&R Block and TurboTax, or even other ‘budget’ options like TaxAct. TaxSlayer also includes many of the high-end features you’d expect from a premium software, but the absence of audit defense is arguably a weakness for those looking for support with complicated tax returns.

Overall, TaxSlayer offers excellent value for the vast majority of filers, with strong features, a solid user experience, and reasonable support.

Check out our roundup of the Best Tax Accounting Software

How much does TaxSlayer cost?

TaxSlayer faces a choice of packages suited to different needs (and budgets). We’ll be focussing on their higher-end packages, because these are the ones that small businesses will find most useful.

TaxSlayer has a free option, and unlike those offered by many competing tax software companies, it really is free regardless of needing to file a state tax return. However, it’s only for those filing a 1040EZ and state return. A small business will have more demanding needs. This means paying for one of the more advanced packages.

Paid TaxSlayer plans range from as little as $24 for the Classic plan (not including state taxes), up to $47 for federal taxes (plus an extra fee of $29 for state taxes with the Self-Employed plan). That’s a total of $76 for each year of filing with the most advanced plan (each additional year of state taxes is an extra $29). With the features included, that’s a bargain.

TaxSlayer features

Many new entrepreneurs are surprised to find that filing taxes as a business owner can be much more complicated than expected. For this reason, tax software companies like TaxSlayer offer a range of packages where prices and features reflect the different requirements of everyone: employees, people with investment income, retirees, the self-employed, and small business owners.

When you open TaxSlayer for the first time, you may be pleasantly surprised. Although it’s a very affordable option, TaxSlayer is also a reasonably attractive piece of tax software. At a cheaper price point than TaxAct, this is a considerable advantage if user experience is important.

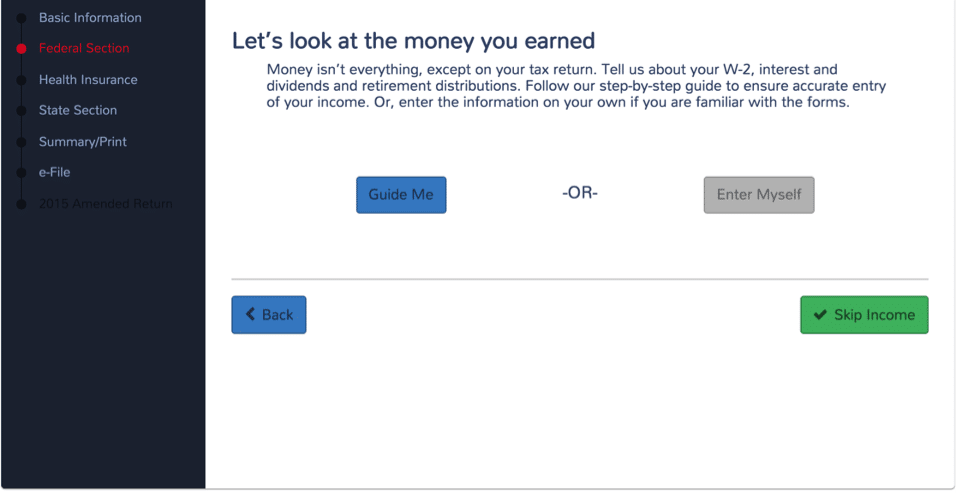

Using TaxSlayer is simple. It’s interface works well and it’s easy to see where you are in the tax preparation and filing process. TaxSlayer also comes with an excellent interview-style Q&A system which it uses to get information for you in a way that’s both simple and painless.

One of the most useful features (which you’ll also find among TaxSlayer’s more expensive rivals) is the W-2 upload feature, which saves you from having to painstakingly type information into the system yourself. Again TaxSlayer isn’t unique for having a feature like this, but at this price point, it’s surprisingly good value.

TaxSlayer packages and pricing

| Simply Free |

|

| Classic |

|

| Premium |

|

| Self-Employed |

|

We do our best to keep this information up-to-date, but before making your decision double-check TaxSlayer’s website as prices may have changed.

Considering the features on offer and the prices, you might expect there to be a downside. However, we couldn’t find any (at least when it comes to features for preparing and filing). TaxSlayer offers a great range of features in a user-friendly design that gets the job done just as well as any of the more expensive competition.

Does TaxSlayer have customer support?

TaxSlayer has two visible weaknesses. The first is relatively watered-down customer support. The chat feature only covers tech support (so you can’t get tax support through chat). If you want tax help from a human, you’ll have to purchase the Premium or Self-Employed packages. Replies aren’t instant, however, and it can take up to 48 hours to get an answer.

There is still a fairly good knowledge base that users can access. It’s worth remembering that you’re probably not the only person who has ever faced the specific tax or tech issue you’re having, so the majority of answers you need can be found there.

What’s not included?

TaxSlayer Premium and Self-Employed come with audit assistance (where TaxSlayerprovidese guidance on what to expect when being audited and how to prepare). However, this isn’t included in the lower-priced plans and you’ll have to pay an extra $29.99 if you want to add it to a cheaper plan. You won’t qualify for audit assistance if you’re filing a Schedule C or are a freelancer.

It’s also worth noting the difference between audit ‘assistance’ and ‘defense’. Audit defense would include things like representation before the IRS, and there’s currently no way to get this from TaxSlayer. Not having this as an option is TaxSlayer’s second noticeable weakness.