Small businesses can be hugely rewarding to own and operate, but they do come with some challenges. Payroll, for example, isn’t always as easy as it might sound. With a variety of confusing factors to consider like deductions, benefits, and dozens of forms, managing payroll as a small business owner can be tough. Payroll services can help reduce confusion and get it done right.

Paycor overview

Paycor may not be as well-known as Intuit Payroll, but it’s certainly impressed many reviewers in the past for its customizable functionality, competitive costings and price structure, and intuitive user experience.

We’ll be reviewing Pacor’s features, price packages, optional extras, and comparing it to alternative payroll services. We’ll finish with our final verdict on whether Paycor is a sensible choice for small businesses looking for help with their payroll.

Check out our roundup of the Best Payroll Services for Small Business

Paycor features

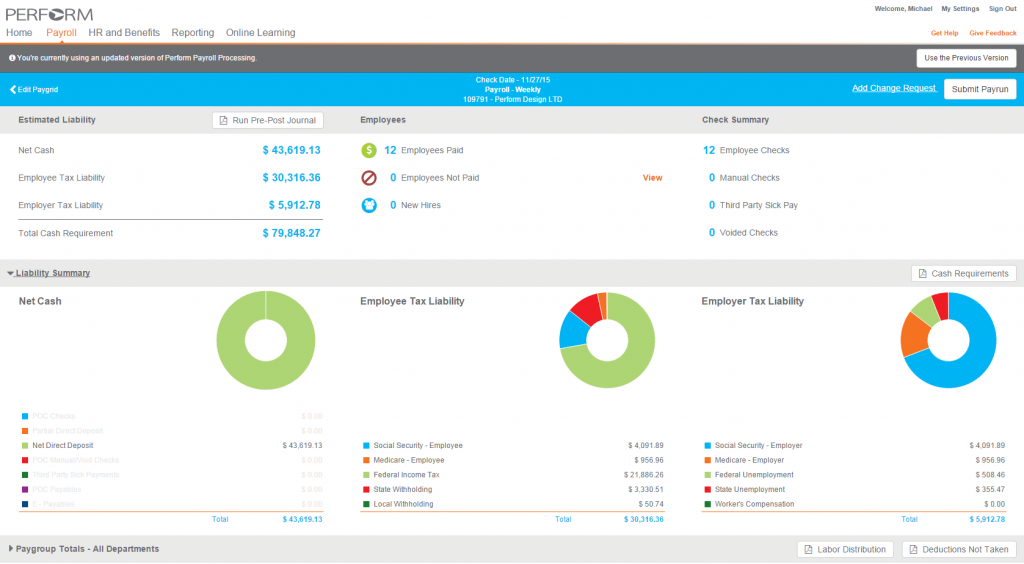

The first things small business users tend to talk about when asked about their experience using Paycor for their payroll are the widgets. Paycor’s customizable user interface means you can add and remove different features on your dashboard as you need them. This means you’re not taking up space with the information you don’t need or want, but if your needs change so can the information you can see at a glance. This system brings clarity to users and makes managing payroll far less painful.

Beyond helping with payroll directly, Paycor has the following useful features which can make a small business owner’s life easier:

- A modular system that’s well-integrated

- Electronic document storage

- Employee self-service functions

- Industry-based customization

- Appealing visuals in online reports and the user interface

- The ability to add new features over time as your needs grow, which can help in areas like onboarding, workforce analysis, and time/attendance tracking and management

Paycor can, therefore, be considered much more than a payroll service, and their features reflect this.

Paycor has been in the payroll service market for years, and their payroll features are now well-tuned to the needs of small businesses. Here are Paycor’s payroll specific features:

- Smart streaming

- Employee support

- Tax compliance assistance

- Process optimization

- General ledger integration

- Human Resources on demand (an HR database plus over-the-phone help)

- Detailed reporting and analytics

- Paycor mobile app

- Direct deposit

- Paycard integrations

- 401k integration

- Wage garnishment support for payments and notice review

- e-Child support compliance assistance with automation

- Tax compliance assistance

Our reviewers found the Paycor mobile app particularly impressive compared to others on the market. Overall, the integration of features across all online versions appears strong, enabling a fast and easy payroll experience.

Paycor pricing and packages

Paycor is currently emphasizing customizability and avoid laying out their pricing in a clear table in the same easy-to-read fashion as other payroll providers like Gusto. However, you might take the view that this means you end up with a price of package tailored to your needs. Others might feel uncomfortable by this apparent shyness about price.

If you want to get a quote you can, but you need to answer some fairly specific questions on the Paycor website about your company and its practices and fill out your contact information. You can also call to receive a custom quote.

If you’re purely interested in payroll the following price information may be helpful. Unlike other payroll services who often charge per month, Paycor charge per payroll cycle. This means that if you pay your employees every two weeks as opposed to monthly, you may pay up to twice as much.

The base price per pay cycle is $49. On the positive side, this covers you up to your first 10 employees, and you don’t start paying for each additional employee until your eleventh. That’s different from Gusto, where every employee counts towards the per employee cost.

Paycor charge $3 for each extra employee per payroll cycle, which is lower than Gusta’s $6 on the Gusta Core plan and much lower than Gusta Complete and Concierge ($12).

Overall, the costs between comparable small businesses of between ten and twenty employees work out the same, and only for higher priced packages with extra features needed by larger businesses do larger differences begin to appear.

Alternatives to Paycor

- Paycor’s biggest rival in terms of ease of scaling is Gusto, at least in terms of price. Paycore has an edge in terms of customizability, however. Both payroll services have comparable features with excellent user experiences and any small business owner, manager, or director interested in one should consider the other before making a decision.

- Another comparable payroll service provider for small businesses emphasizing convenience is Intuit. Intuit Payroll offers excellent integrations in popular accounting software used by many small businesses (Intuit Quickbooks) and offers a solid user experience and a combination of features.

Should small businesses use Paycor?

If your small business is growing fast and you need to scale your HR functionalities to match, Paycor makes sense as a payroll service. The analytic tools are helpful, and the software is extremely user-friendly. Considering these factors and the competitive price point, Paycor deserves its place among our top payroll providers for small businesses.