Small businesses and freelancers often struggle with their taxes, which is where special tax software can help. Whether it’s avoiding trouble with the IRS, saving money by not hiring an accountant, or knowing what you need to do, tax software can be a huge help for small businesses and freelancers. But which should you pick?

In this review, we’ll see if H&R Block is the right choice for small businesses. H&R Block is widely considered one of the top options, but how does it stack up against competitors like TurboTax? Here’s what we found.

Summary

H&R Block is certainly affordable compared to their main rivals TurboTax, and the Free Edition will give you greater functionality, too. It’s pleasing to note that even at a cheaper price point, H&R Block also includes many of the same great features you have to pay more for elsewhere.

However, while it’s certainly simple to use with a visually appealing design, it’s not quite as sleek as TurboTax and occasionally special terminology aren’t explained very clearly.

On the plus side, H&R Block offers great support, strong user experience, and a terrific suite of features for a fair price.

Check out our roundup of the Best Tax Accounting Software

How much does H&R Block cost?

H&R Block offers a range of package options, each at different price points. You can also add features you’re interested in having that aren’t included in your package (such as audit protection at $19.99) at a small extra cost.

Prices range from free if you can get by with a more limited set of features, up to $74.99 for the premium plan. Set against TurboTax, who charge up to $199.99 for their top ticket item, this represents a considerable saving.

Given the importance of filing your taxes correctly and the relatively low cost of H&R Block for the excellent suite of features you receive with the premium plan, we’d recommend taking this option (especially if you’re a freelancer or run a small business).

H&R Block features

If you’re a freelancer, small business, or have investment income, chances are that filing your tax return could be considerably more complicated than for a regular employees personal income. As a result, the features you get with H&R Block can be particularly useful.

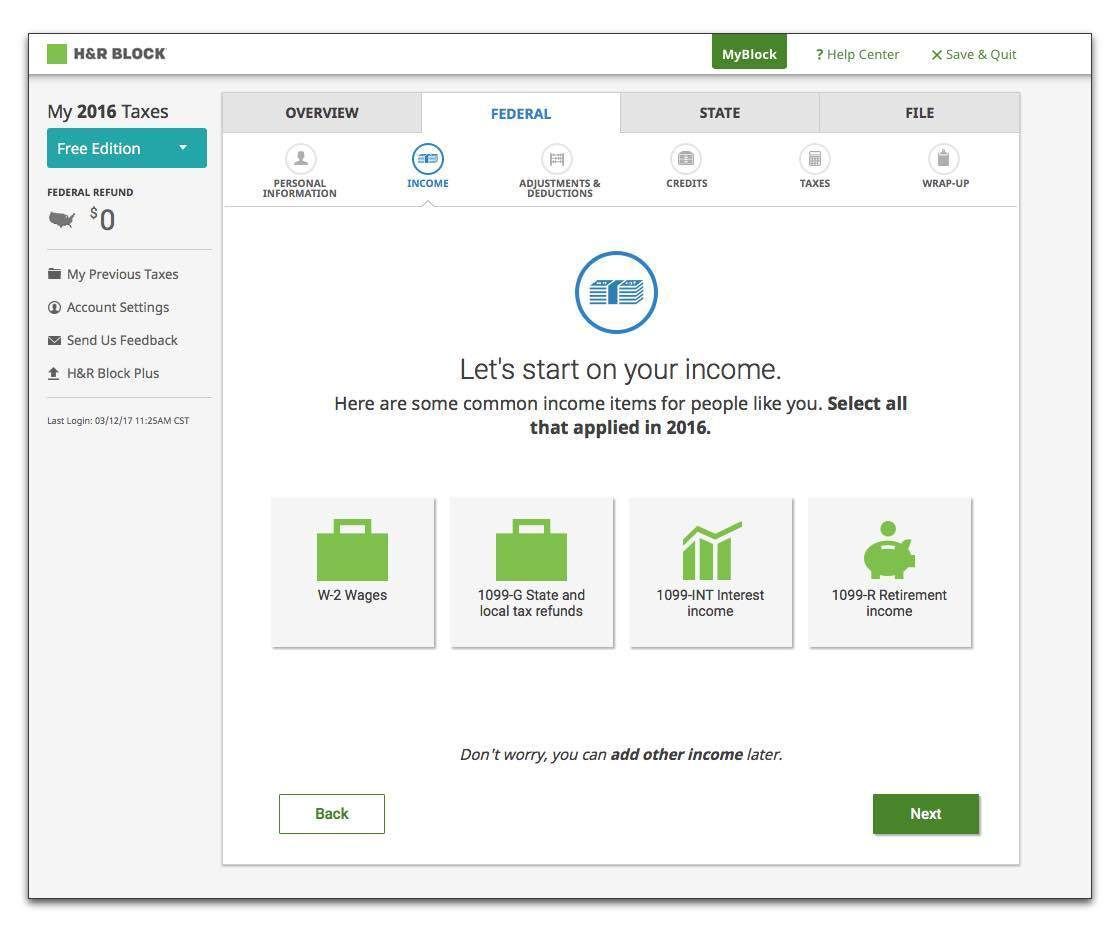

H&R Block is simple to use and you’ll find it easy to get an answer to a question. If you find you need to upgrade, you’ll be able to do so without much hassle.

Of course, with a range of packages available, the specific features you get depend on your H&R Block plan.

Regardless of your selection, you’ll find H&R Block’s ‘semi-guided’ user interface intuitive and clear layout well-optimized for getting things done without fuss. A clear menu at the top guides you through the process, and it’s easy to find your way back to anything you need to change later.

One of the best features is the W-2 upload feature, which lets you take a picture of your W-2, which H&R Block then uses to auto-populate the information from that document. This eliminates a great deal of hassle.

H&R Block packages and pricing

| Free |

|

| Deluxe |

|

| Premium |

|

| Self-Employed |

|

While the above information was accurate at the time of posting, we recommend you check H&R Block’s site to ensure you’re up-to-date on their current price structure.

However, there’s no doubt that for the benefits H&R Block provides at these prices, they’re more affordable than TurboTax, who we rate as their closest competitor. Beyond simply charging less for their higher-end packages, H&R Block also includes more of their premium features in their lower-tier offerings, and unlike TurboTax don’t even charge for state taxes with their free version.

Does H&R Block have customer support?

H&R Block comes with customer support that is at once comprehensive and professional. You get preparation support throughout the filing process as standard with all paid options and the help feature is easy to locate.

You can also opt into extra support if you need to, such as audit support. If you have a more complex return – which you likely will if you operate your own business – then getting this extra add-on represents excellent value for money. H&R Block will help you prepare for your audit and will even attend it with you. Given the technicalities involved, this can be a huge helping hand for those who find the world of tax confusing.

The only slight drawback we found is the explanation of specialist terminology, which isn’t always as clearly explained as you might hope. However, a simple search can often clear up any confusion, and you can always rely on the live chat that comes with the paid features if you have any questions.

To access this extra help, navigate to the ‘Help’ section, enter your query into the search box, and click the ‘Get Additional Help’ option once you get the results.

What’s not included?

We’ve already seen that audit support is $19.99 extra. If you’ve paid for the premium or self-employed options, however, you’ll find that you’ll have everything else you need. This includes a review by a tax professional and live chat support.

However, it’s worth remembering that filing for state taxes is always $36.99 extra if you aren’t using the free version.