There are so many different forms that are integral to the US tax system. From Forms 1099, W-2 and W-4, it can seem daunting to keep track of each one. Also, the tax code has nearly doubled since 1985, so it can be tough to keep track of updates. However, it’s wise to know a few crucial forms before learning about others.

Forms W-2 and W-4 might sound similar but they have many differences, broadly speaking:

- The W-2 form is used by non-contract employees to report their wages and tax deductions to the government during tax season.

- The W-4 form is given by the employer to an employee to determine paycheck withholding.

The main purpose of the W-2 form

Form W-2 is important because all employees use it to report their income and tax deductions to the IRS. In fact, employees are usually referred to as “W-2ers” since this form is so common. (Conversely, contract workers are nicknamed “1099ers” since an employer would use form 1099, to record their income.)

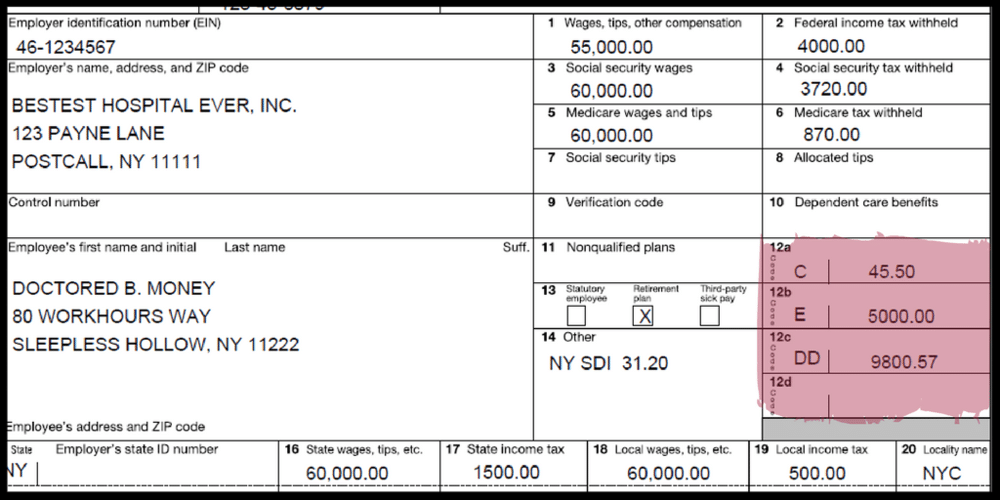

The W-2 is a comprehensive tax form that records an employee’s income from a single employer throughout the year. It also shows more detailed information about various deductions like 401(k) contributions, employer health insurance contributions, HSA contributions, and more. These boxes are shown in the top left portion of the form and are categorized by specific letters.

Common form W-2 deductions and the corresponding letters

There are many W-2 deduction codes, but this article will only focus on the most commonly used ones.

- D – Employee 401(K) contributions: Include employer matches and simple 401(k) deferrals. This is one of the more common codes as most employees contribute to a work-sponsored 401(k). These plans allow the employee to save for retirement on a pre-tax basis with the current annual limits being $19,000 for those under the age of 50 and $25,000 for employees over 50.

- DD – Cost of employer-sponsored healthcare: Most Americans receive healthcare through an employer, which is very cost effective. One of the main benefits of full-time employment is health insurance, which is very expensive on an outside marketplace. In fact, non-employer subsidized premiums cost on average $440 for an individual and $1,168 for family coverage.

- C – Taxable costs of group-term life insurance over $50,000: This amount is also included in income boxes 1, 3 and 5. Most employers offer their employees group term life insurance, which allows them to protect their dependents in case of untimely death. It’s important to note that group term life insurance is excluded from tax if the amount is under $50,000. Also, group term life insurance (GTL) is one of the most common imputed income lines, which appears on each employee’s paystub. Per Patriot Software, “Imputed income is the value of a service or benefit provided by employers to employees, which must be treated as income.” Some other examples of imputed income include company trips, cars, and even gym memberships.

- V – Income from NQSO or non-statutory stock options: Included in Boxes 1, 3 5. Stock options or equity awards are popular ways to incentivize employees to perform well. Lastly, the amount shown on code V reflects the difference between the fair market value of the stock and strike price of the options when exercised. This amount has already been taxed and you can learn more via IRS publication 525.

- W – Employer contributions and employee contributions to an employee’s health savings account (HSA): An HSA is a popular savings account that allows employees to save on a pre-tax basis for healthcare costs. These employees can also pay for qualified medical expenses on a tax-free basis and contribute up to $3,500 per person or $7,000 per family annually. Employees older than 55 can contribute an additional $1,000 and it’s important to note that employer contributions reduce the amount an employee can contribute. So, if an employer contributes $1,000, an individual can only defer $2,500 to the plan.

Common Form W-2 income items:

The W-2 also shows common income items like wages, social security wages, federal tax withheld, state tax withheld, social security tax, and Medicare tax. Some of these boxes are self-explanatory, while others like social security wages aren’t.

Social security wages are higher because they include pre-tax contributions exempt from federal/state taxes, but not exempt from social security tax like 401(k) deferrals. The social security wage base is used by the government to calculate social security benefits based on an employee’s lifetime earnings. There are other factors used to calculate social security and this article goes into more detail.

Other common Form W-2 and W-4 fields:

Some other W-2 and W-4 boxes include the employer address, employee address, control number, and state numbers. The last two numbers are important since they allow the federal and state governments to identify the employer. These numbers generally don’t change, which makes it easier for an employee to prepare his or her taxes. For example, popular tax software like Turbo Tax already has these numbers built-in from prior years.

Check out our roundup of the Best Tax Accounting Software

What is Form W-4’s purpose?

Both the W-2 and W-4 are commonly interchanged, yet the W-4 is an important form that allows employees to tell their employer the amount they’d like to be withheld from each paycheck. W-4s are usually offered along with several important documents like I-9 identity forms during employee onboarding. Having employees fill out a W-4 prior to starting a job or on the first day can be a great way to be efficient. In fact, many employers use HR software like Namely to complete this task.

Employees use a tax item called an allowance to determine how much their employer should withhold per paycheck. An employee would generally choose one allowance for themselves, another for a spouse and an additional one for each dependent. A rule of thumb regarding allowances states that the more allowances are chosen, the less tax will be withheld. Conversely, fewer allowances lead to higher tax withholding and tax refunds.

The most important concept related to form W-2 and W-4 is to choose enough allowances to get a small refund, instead of owing a tax bill. Conversely, it’s wise not to receive a large refund as this means that an employee over-withheld on their paycheck and gave the IRS an “interest-free” loan. Instead of getting a large refund, that money could have been used throughout the year to invest, save, and pay down debt.

Exemptions, W-2, and W-4

Exemptions have been usually mistaken for allowances and used to impact taxes as well. Prior to President Trump, there used to be exemptions which would exclude $4,050 from your taxable income.

Prior to the tax year 2018, a taxpayer could get additional exemptions for spouses and dependent children. Although exemptions have been removed from the tax code, there is an option to been exempt from federal tax withholding by writing exempt in box 7.

This is only recommended if an employee foresees himself or herself not having any taxable income. For instance, if a single filer made just $10,000, he or she wouldn’t pay taxes since his or her standard deduction ($12,000) is greater. Marking box 7 could be a good idea if a worker, like a high schooler, is at a part-time job and is expecting to earn little money.

Additional sources of income can impact forms W-2 and W-4:

Some full-time workers have decided to work at traditional part-time jobs in retail, restaurants and other industries to supplement their income. In this case, it could be prudent to have zero or very few allowances. Some full-time workers that have additional part-time jobs have a standard amount of allowances on their W-4s at their full-time jobs with no allowances at the part-time job. Others split the total amount of allowances between the full-time job and a part-time job. It’s important to not under withhold income as the person would be subject to a tax bill as well as underpayment penalties.

Most W-2 employees don’t have to pay quarterly taxes to the government. The only exceptions to these cases are high earning employees that receive large bonuses, exercise equity awards and employees who significantly under withheld their paychecks. Luckily, the latter example can avoid making payments and unnecessary penalties by choosing the standard amount of allowances. To recap, a common suggestion for allowances would be to allocate one per person, spouse, or dependent.

Dependents, allowances, W-2 and W-4 are all interrelated, which is why it’s important to determine if your dependent can be claimed for tax purposes. The rules surrounding dependents can be confusing, so this guide can provide some clarification.

Bottom line

There are many tax forms and which can be overwhelming at times. However, it’s important to realize which are the most important forms for employees.

- The W-2 and W-4 are important for managing employees because they allow employers to record an employee’s income, deductions, addresses, and withholding amounts.

- These forms work in tandem to accurately reflect an employee’s tax contributions and to make filing returns more streamlined.

- Luckily, employee’s can enter their information from their W-2’s into tax preparation software like Turbo Tax and H&R Block, if they wanted to self prepare their taxes.