With mortgage rates at a 21-year high, new homeowners are faced with making a long and expensive financial commitment to pay off their homes.

We took a closer look at where homeowners are most likely to have unpaid mortgages by analyzing housing data in 170 of the most populous cities across the country, according to the U.S. Census Bureau.

Specifically, our analysis focused on determining the percentage of homeowners who have mortgages on their homes and those who do not.

Key findings

- Nationwide, 51.1 million homeowners have unpaid mortgages, which is 61.3% of all homeowners.

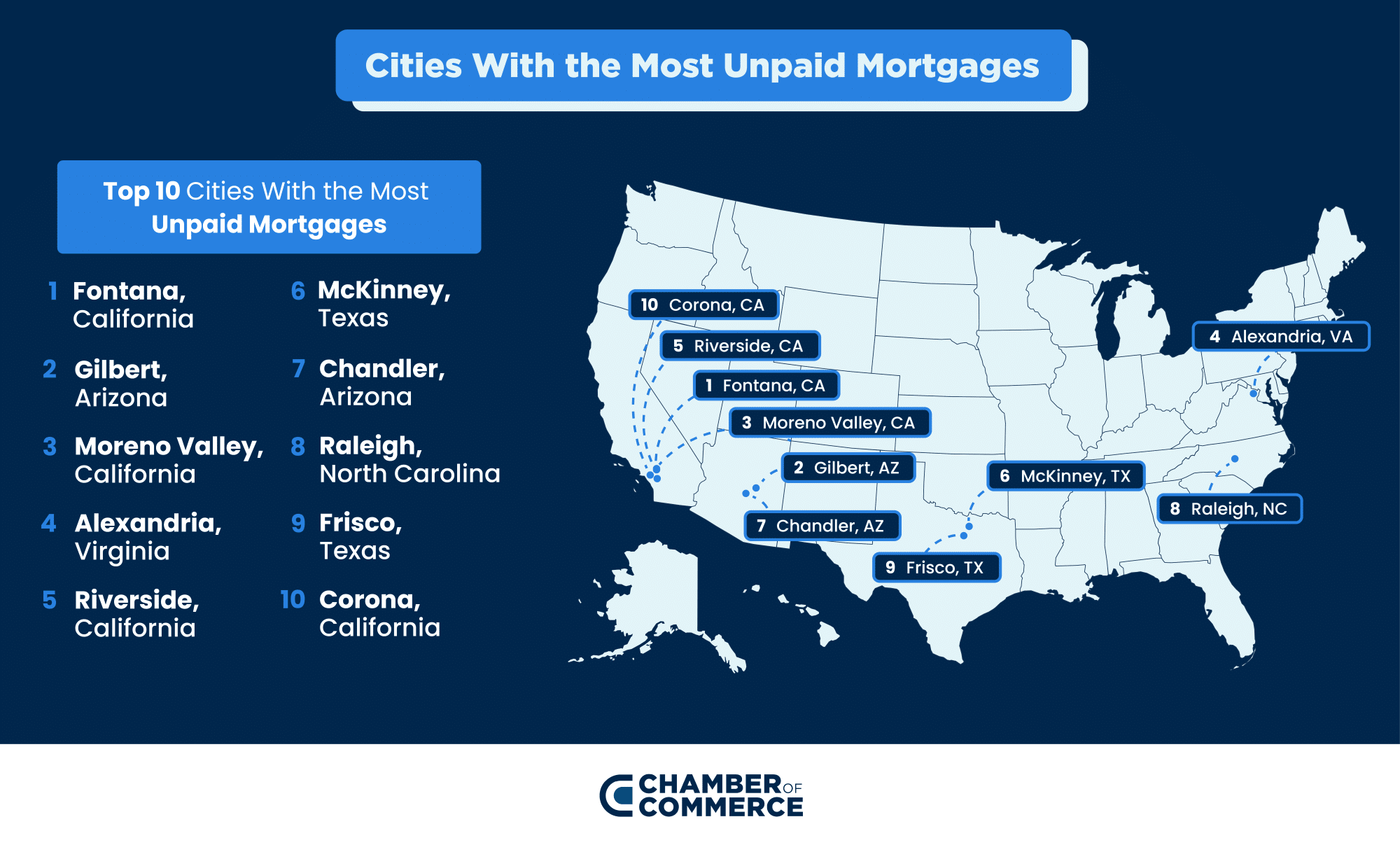

- Cities in California dominate the top five list, with Fontana holding the No. 1 spot, Moreno Valley at No. 3 and Riverside ranked No. 5.

- Elsewhere, two cities within the Dallas metropolitan area rank within the top 10, including McKinney, Texas (No. 6) and Frisco, Texas (No. 9). McKinney also ranks No. 1 for cities with the newest homeowners, with a median residence duration of only five years.

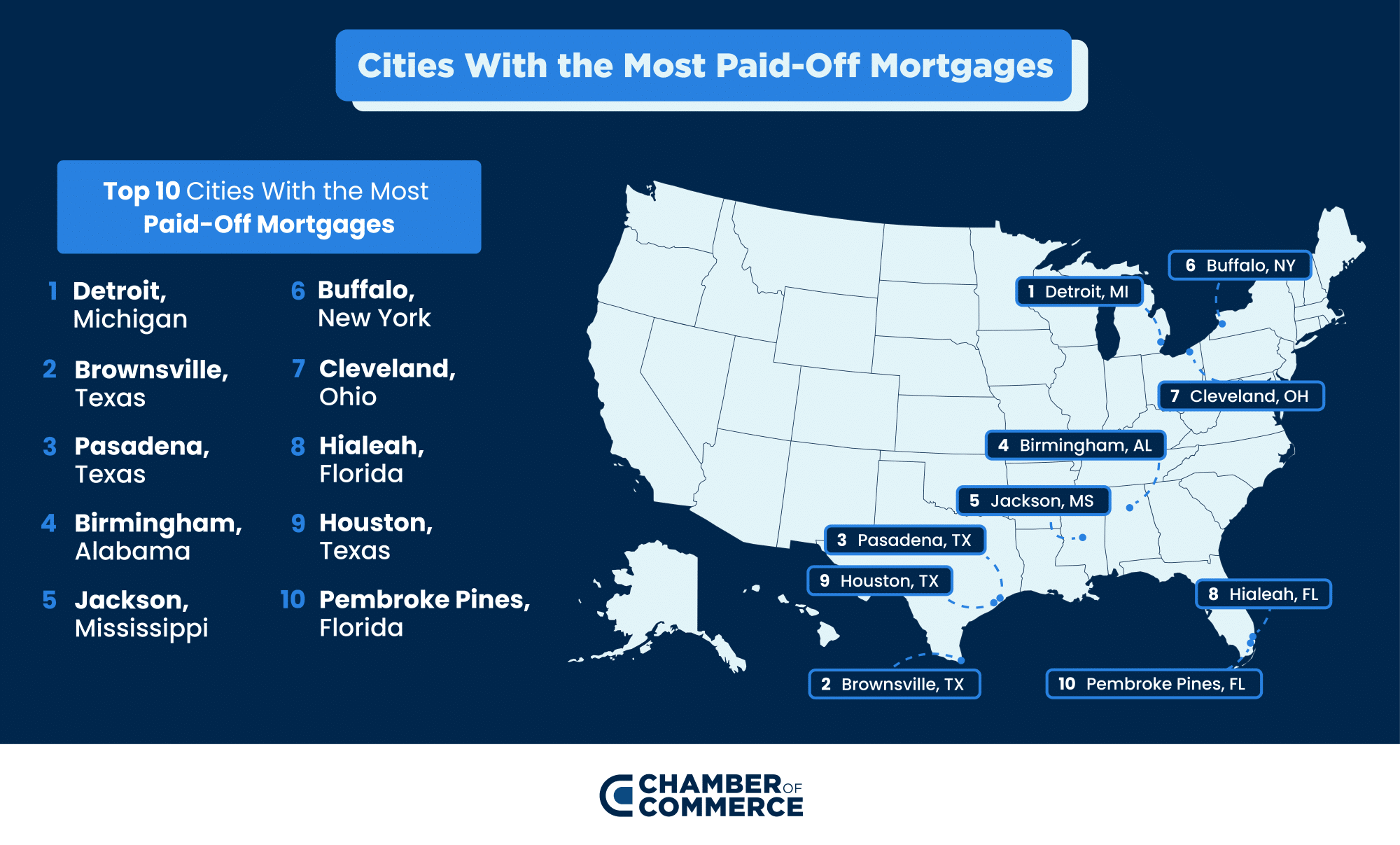

- In terms of cities with the most paid-off mortgages, Detroit, Michigan ranks No. 1, with 66.2% of its homeowners being mortgage-free.

Which cities have the most unpaid mortgages?

Not only does California have the most expensive median monthly housing costs in the nation, but several of its cities also lead the list of cities where homeowners have the most unpaid mortgages.

Among the top 50 cities with the most unpaid mortgages, 18 are in “The Golden State.” A majority are located within the Los Angeles metropolitan area such as Fontana, Moreno Valley, Riverside, Corona, Ontario, Santa Clarita, Palmdale, Rancho Cucamonga, and the city of Los Angeles.

However, it’s Fontana, California that claims the top spot. Overall, 82.5% of Fontana homeowners have an outstanding balance on their mortgage, and less than one in five homeowners in Fontana have paid off their homes completely.

It’s probably not surprising that so many in Fontana have unpaid mortgages, given the high monthly housing costs for Fontana homeowners. Fontana’s monthly housing costs are $2,236, which is 34% higher than the national average of $1,672, according to the Census Bureau.

Also, more than one-third of Fontana homeowners are living beyond their means. In total, 38% of homeowners in Fontana spend more than 30% of their income on housing costs, which is above the national average of 27.4%.

Elsewhere in California, San Francisco comes in at No. 1 for cities with the most expensive housing costs. The median monthly cost to be a homeowner in San Francisco is nearly $4,000 ($3,964), and more than two-thirds of San Francisco homeowners still have outstanding balances on their mortgage.

Outside of California, the fast-growing Phoenix suburb of Gilbert, Arizona comes in at No. 2, with 79.2% of its homeowners living with a mortgage. Elsewhere, the Phoenix suburb of Chandler ranks 7th, with 77% (or 54,712) of its homeowners living with a monthly mortgage payment.

Homeowners in both cities are relatively new, with a median housing tenure of 6 years for Gilbert residents and 8 years for Chandler residents. Considering it takes an average of 30 years to pay off a mortgage, residents in both cities have quite a journey ahead to fully pay off their homes.

Top five cities with the most unpaid mortgages

#1. Fontana, CA

- Homeowners with unpaid mortgages: 32,565

- Median years lived in home: 9

- Median monthly housing costs: $2,236

- Percentage of homeowners with unpaid mortgages: 82.5%

#2. Gilbert, AZ

- Homeowners with unpaid mortgages: 55,398

- Median years lived in home: 6

- Median monthly housing costs: $1,921

- Percentage of homeowners with unpaid mortgages: 79.2%

#3. Moreno Valley, CA

- Homeowners with unpaid mortgages: 26,147

- Median years lived in home: 13

- Median monthly housing costs: $1,991

- Percentage of homeowners with unpaid mortgages: 78.9%

#4. Alexandria, VA

- Homeowners with unpaid mortgages: 24,232

- Median years lived in home: 7

- Median monthly housing costs: $2,684

- Percentage of homeowners with unpaid mortgages: 77.8%

#5. Riverside, CA

- Homeowners with unpaid mortgages: 39,744

- Median years lived in home: 13

- Median monthly housing costs: $2,061

- Percentage of homeowners with unpaid mortgages: 77.6%

Along with analyzing cities with the most unpaid mortgages, we also looked at cities with the most paid-off homes.

No other city in America has more paid-off homes than Detroit, Michigan. Two-thirds (66.2%) of homeowners in Detroit have completely paid off their homes, according to the Census Bureau.

In contrast, only 38.7% of all homeowners nationwide have paid off their mortgages. “The Motor City” also has one of the lengthiest median homeowner tenures in the nation, at 16 years.

Rounding out the top five cities with the most paid-off homes are Brownsville, Texas (58%), Pasadena, Texas (54.5%), Birmingham, Alabama (50.7%) and Jackson, Mississippi (50.2%).